The Costs of Job Displacement over the Business Cycle and Its Sources: Evidence from Germany

The Costs of Job Displacement over the Business Cycle and Its Sources: Evidence from Germany

Author: Johannes F Schmieder

Author: Till M. von Wachter

Author: Jörg Heining

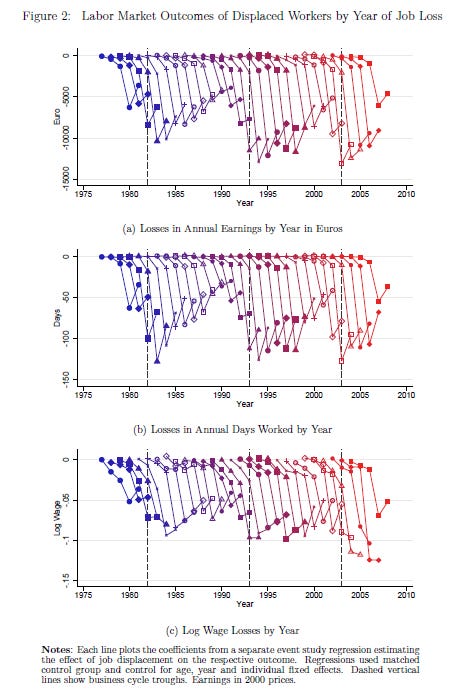

Abstract: We document the sources behind the costs of job loss over the business cycle using administrative data from Germany. Losses in annual earnings after displacement are large, persistent, and highly cyclical, nearly doubling in size during downturns. A large part of the long-term earnings losses and their cyclicality is driven by declines in wages. Key to these long-lasting wage declines and their cyclicality are changes in employer characteristics, as displaced workers switch to lower-paying firms. Changes in characteristics of workers or displacing firms explain little of the cyclicality, though non-employment durations correlated with losses in employer effects play a role.

URL: https://www.nber.org/system/files/working_papers/w30162/w30162.pdf

Accessed: 9/7/2022, 3:01:52 PM

Reading Notes:

Objective: To understand how the long-run costs of job displacement vary across the business cycle. What is the role of the firm?

Background: Job losses have important long-run impacts, both on earnings and other outcomes

Data & Key Variables: Sample of male workers from West Germany 1975-2009

Mass layoff event: employers of >50 employees, 30% employment decline or establishment closure

Full-time workers with at least 3 years of tenure before displacement

Methodology: Propensity score matching of job displacements and non-displaced controls

AKM to capture establishment fixed effects

Decomposition of costs

Results: Earnings losses due to job displacement during a mass layoff are twice as large during recessions compared to during booms.

Short term this difference is explained by lower reemployment, but long term it is due to working at smaller establishments with lower wage premiums

Key Table/Figure:

(actually, this figure doesn’t show the main results as well as some other figures, but I really like this figure, so decided to highlight it instead).