The Racial Wealth Gap, Financial Aid, and College Access

The Racial Wealth Gap, Financial Aid, and College Access

Author: Phillip B. Levine

Author: Dubravka Ritter

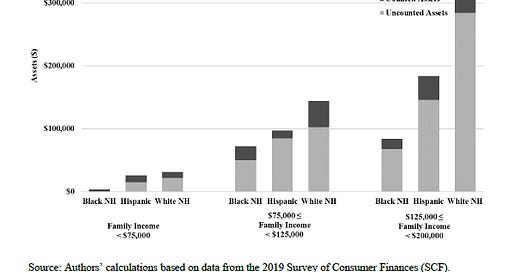

Abstract: We examine how the racial wealth gap interacts with financial aid in American higher education to generate a disparate impact on college access and outcomes. Retirement savings and home equity are excluded from the formula used to estimate the amount a family can afford to pay. All else equal, omitting those assets mechanically increases the financial aid available to families that hold them. White families are more likely to own those assets and in larger amounts. We document this issue and explore its relationship with observed differences in college attendance, types of institutions attended, degrees attained, and education debt using data from the Survey of Consumer Finances (SCF), the National Postsecondary Student Aid Study (NPSAS), and the Panel Study of Income Dynamics (PSID). We show that this treatment of assets provides an implicit subsidy worth thousands of dollars annually to students from families with above-median incomes. White students receive larger subsidies relative to Black students and Hispanic students with similar family incomes, and this gap in subsidies is associated with disadvantages in educational advancement and student loan levels. It may explain 10 percent to 15 percent of white students’ advantage in these outcomes relative to Black students and Hispanic students.

URL: https://www.nber.org/system/files/working_papers/w30490/w30490.pdf

Accessed: 9/26/2022, 8:20:36 AM

Seminar Notes:

Venue: NBER Economics of Mobility Conference 2022

Objective: To understand how exclusion of some assets in the financial aid formula affects affordability of college by race

Importance: Historical and structural barriers to asset accumulation by race means treatment of assets in federal student aid may have disparate impacts

Background: Stated goal of financial aid system is to improve equity. FASFA Expected Contribution excludes some assets: home equity on primary residence and retirement saving

Data & Key Variables: PSID

Transition to adulthood supplement (biennial beginning in 2005)

Parental data, including wealth

N=2,464

Methodology: Regression of outcomes on estimated expected family contribution (EFC) and EFC reduction [from excluded assets]

Results: Most assets for middle to high-income families are uncounted. Black & Hispanic students are at a financial disadvantage.

Black parents with equal EFC to white parents borrow more

Implicit subsidy increases enrollment in college and those in college are more likely to be in a 4-year college

Key Table/Figure: